ADA Price Prediction: Assessing the Path to $1 Amid Technical and Fundamental Factors

#ADA

- Current technical positioning shows ADA trading below key moving averages but with emerging bullish MACD momentum

- Market sentiment reflects division between aggressive price predictions and current resistance levels

- Achieving $1 requires overcoming significant technical barriers despite positive long-term fundamentals

ADA Price Prediction

Technical Analysis: ADA Price Momentum

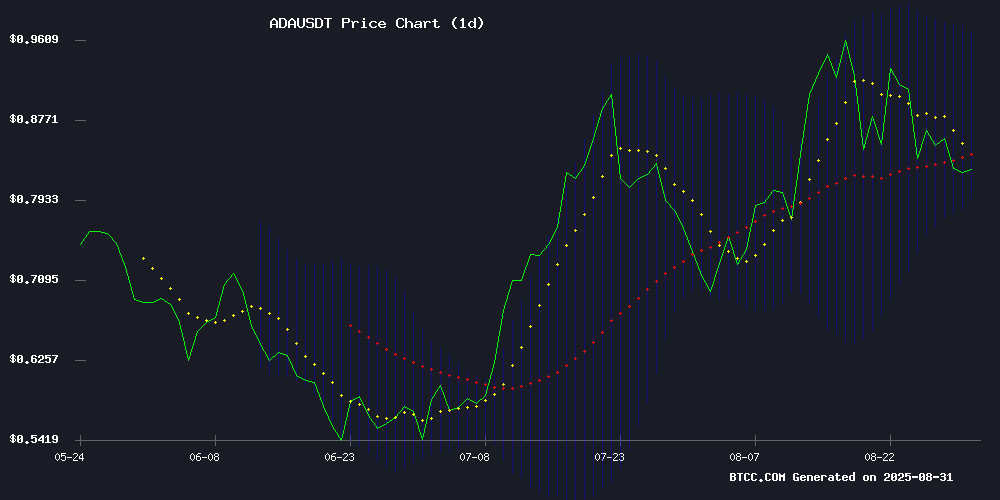

According to BTCC financial analyst William, ADA's current price of $0.8269 sits below its 20-day moving average of $0.8822, indicating short-term bearish pressure. However, the MACD reading of 0.022784 suggests emerging positive momentum, while the Bollinger Band position shows ADA trading closer to the lower band at $0.7956, potentially signaling an oversold condition that could precede a rebound toward the middle band at $0.8822.

Market Sentiment: Mixed Signals for ADA

BTCC financial analyst William notes that recent headlines present conflicting narratives for Cardano. While some predictions suggest aggressive targets reaching $4-$10, these optimistic forecasts contrast with current technical indicators showing resistance NEAR $0.97. Market sentiment appears divided between long-term bullish expectations and short-term technical realities, requiring cautious interpretation of price prediction articles.

Factors Influencing ADA's Price

Cardano Price Predictions for 2026 Spark Investor Concerns Amid Market Volatility

Cardano's ADA token faces a precarious outlook for 2026, with analysts warning of a potential drop to $0.20 if bearish market conditions persist. Currently trading at $0.822, the asset shows fleeting bullish signals but remains vulnerable to broader crypto market pressures.

Technical indicators present mixed signals—a looming 3-hour golden cross contrasts with resistance at $0.90. While ecosystem upgrades and rising open interest offer some optimism, macro trends threaten to cap gains. Divergent analyst views range from predictions of ADA retesting its $3.10 all-time high to catastrophic declines.

The emergence of utility-focused projects like Remittix (RTX) highlights shifting investor preferences toward tangible use cases during market uncertainty. Market participants now weigh short-term volatility against Cardano's long-term potential, with the specter of a 75% price collapse looming over 2026 projections.

Cardano Price Forecast: Analyst Predicts 300% Rally to $4 by Year-End

Cardano (ADA) is gaining renewed attention as analysts project a potential 300% surge to $4, despite its underperformance relative to other altcoins this cycle. Mintern, Minswap DEX's Chief Meme Officer, cites a bullish Elliott Wave structure and Fibonacci extensions targeting $1.47-$4.14, with the upper bound representing a 200% retracement level.

Skepticism persists as ADA stagnates NEAR $0.80, with critics highlighting its laggard status in the current bull market. The technical outlook suggests either a major breakout or confirmation of weakening momentum, making this one of the most divisive altcoin narratives of 2024.

Cardano Crypto Week: 2 Big Updates Reveal $ADA Price Target $10

Cardano's ADA token is gaining attention with two significant developments. The Ouroboros Leios upgrade, a long-anticipated enhancement, has entered public review. Meanwhile, Grayscale, a $60 billion asset management firm, has filed for official inclusion of ADA in its offerings.

These updates could propel ADA toward its $10 price target, reflecting growing institutional interest and technical advancements in the Cardano ecosystem.

Will ADA Price Hit 1?

Based on current technical indicators and market sentiment, reaching $1 represents a significant 21% increase from ADA's current price of $0.8269. BTCC financial analyst William suggests that while the MACD shows early bullish divergence, ADA faces immediate resistance at the 20-day MA ($0.8822) and stronger resistance at the upper Bollinger Band ($0.9687).

| Key Levels | Price | Significance |

|---|---|---|

| Current Price | $0.8269 | Baseline |

| 20-Day MA | $0.8822 | First Resistance |

| Upper Bollinger | $0.9687 | Major Resistance |

| Target | $1.0000 | 21% Increase Required |

While optimistic news headlines suggest potential for significant gains, technical analysis indicates that reaching $1 would require breaking through multiple resistance levels and sustained buying pressure. The mixed signals between technical indicators and news sentiment suggest cautious optimism rather than immediate certainty for the $1 target.